Kelly consulting post-closing trial balance may 31 20y8 – The Kelly Consulting post-closing trial balance as of May 31, 20y8, serves as a critical financial document that offers valuable insights into the company’s financial position and performance. This comprehensive analysis delves into the purpose, significance, and key elements of a post-closing trial balance, providing a thorough understanding of its role in accounting practices.

The post-closing trial balance holds significant importance in the accounting cycle, acting as a crucial step after the closing entries have been posted. It provides a comprehensive summary of all ledger account balances, ensuring that the total debits equal the total credits, thereby maintaining the accounting equation’s integrity.

Kelly Consulting Post-Closing Trial Balance Analysis

A post-closing trial balance is a financial statement prepared after the end of an accounting period, following the closing of temporary accounts. It serves as a verification tool to ensure the accuracy and completeness of the accounting records and to provide a basis for preparing financial statements.

Key Elements and Sections

The post-closing trial balance typically includes the following sections:

- Account name

- Account type (asset, liability, equity, revenue, expense)

- Debit balance

- Credit balance

Accounting Principles and Conventions, Kelly consulting post-closing trial balance may 31 20y8

The preparation of a post-closing trial balance adheres to generally accepted accounting principles (GAAP) and conventions, including:

- The matching principle

- The accrual basis of accounting

- The going concern assumption

Understanding the Date: May 31, 20y8

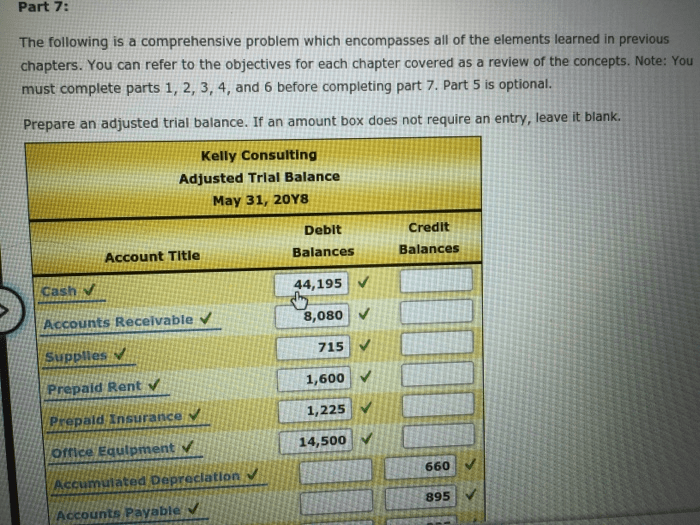

The post-closing trial balance is prepared as of a specific date, in this case, May 31, 20y8. This date marks the end of the fiscal year and the accounting period for which the trial balance is being prepared.

The date is significant because it provides a snapshot of the company’s financial position at a specific point in time. It allows for comparisons to be made with previous periods and for the assessment of financial performance.

Analyzing Account Balances: Kelly Consulting Post-closing Trial Balance May 31 20y8

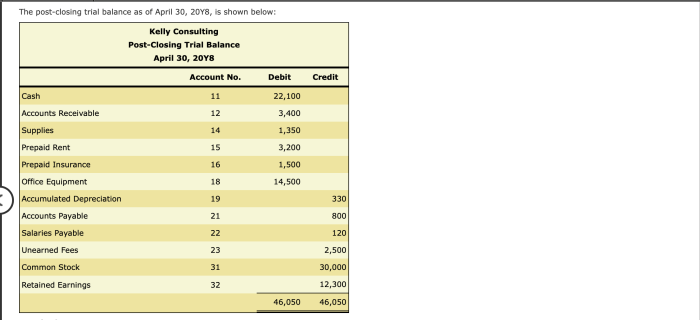

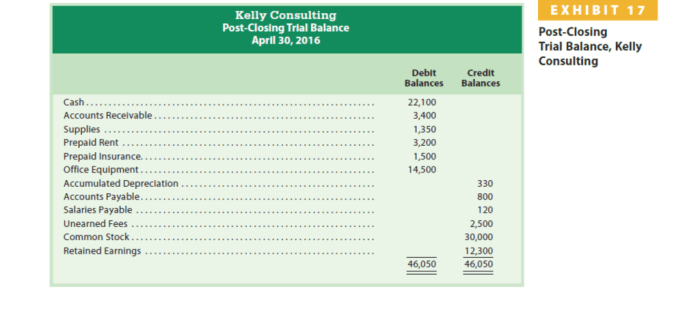

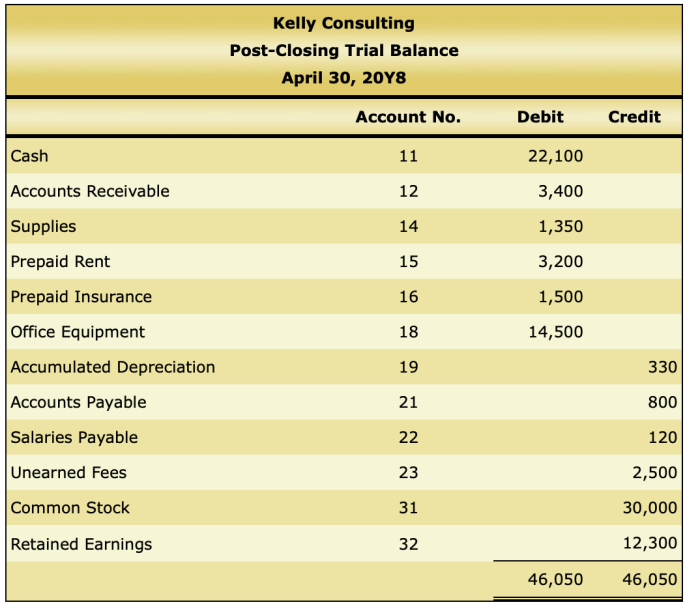

The post-closing trial balance presents the account balances after all closing entries have been posted. These balances represent the company’s financial position at the end of the accounting period.

Unusual or significant account balances may indicate errors or unusual transactions. For example, a large debit balance in an expense account may indicate an overstatement of expenses or an error in recording revenue.

| Account Name | Account Type | Debit Balance | Credit Balance |

|---|---|---|---|

| Cash | Asset | $10,000 | |

| Accounts Receivable | Asset | $5,000 | |

| Inventory | Asset | $2,000 | |

| Prepaid Insurance | Asset | $1,000 | |

| Accounts Payable | Liability | $3,000 | |

| Notes Payable | Liability | $2,000 | |

| Common Stock | Equity | $10,000 | |

| Retained Earnings | Equity | $5,000 | |

| Sales Revenue | Revenue | $20,000 | |

| Cost of Goods Sold | Expense | $10,000 | |

| Salaries Expense | Expense | $5,000 | |

| Utilities Expense | Expense | $2,000 |

Identifying Errors and Omissions

Errors and omissions can occur in the preparation of a post-closing trial balance due to human error or system errors. Common types of errors include:

- Incorrect posting of transactions

- Omission of transactions

- Mathematical errors

Methods to identify and correct errors include:

- Recalculating the trial balance

- Comparing the trial balance to previous periods

- Analyzing account balances for unusual fluctuations

Reconciling the Trial Balance

The post-closing trial balance must reconcile, meaning the total debits must equal the total credits. If there is a discrepancy, it indicates an error that needs to be identified and corrected.

Reasons for discrepancies can include:

- Unrecorded transactions

- Incorrect posting of transactions

- Mathematical errors

Using the Post-Closing Trial Balance

The post-closing trial balance is used for several purposes, including:

- Preparing financial statements

- Preparing tax returns

- Analyzing financial performance

- Auditing financial records

Common Queries

What is the purpose of a post-closing trial balance?

A post-closing trial balance serves to verify the equality of total debits and total credits after closing entries have been posted, ensuring the accounting equation’s integrity.

What are the key elements of a post-closing trial balance?

A post-closing trial balance typically includes account names, account types, debit balances, and credit balances.

How is a post-closing trial balance used in subsequent accounting processes?

The post-closing trial balance serves as the starting point for preparing financial statements, such as the balance sheet and income statement, and is also used for future audits and reviews.