Calculate reconcile your checkbook answer key – Reconciling your checkbook is a crucial financial management practice that ensures the accuracy of your records and helps you track your spending. This comprehensive guide will provide a step-by-step explanation of the process, along with tips, troubleshooting advice, and the benefits of reconciling your checkbook regularly.

Introduction: Calculate Reconcile Your Checkbook Answer Key

Reconciling your checkbook is the process of comparing your checkbook register to your bank statement to ensure that they match. It’s an important part of managing your finances because it helps you keep track of your spending, identify potential errors, and prevent fraud.

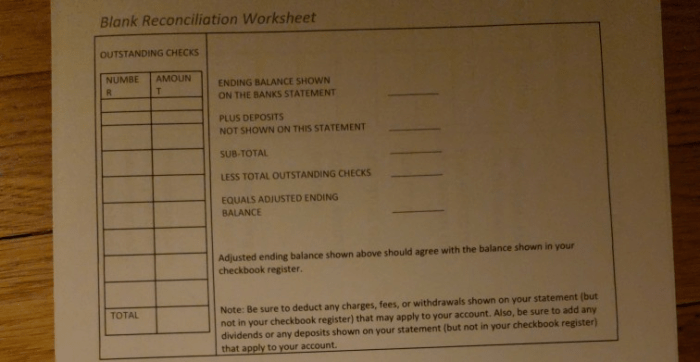

Step-by-Step Guide to Reconciling Your Checkbook

Gather your materials

You’ll need your checkbook register, your bank statement, and a pen or pencil.

Compare your checkbook register to your bank statement

Start by comparing the beginning balance on your checkbook register to the beginning balance on your bank statement. If they don’t match, you’ll need to find out why.

Identify any discrepancies

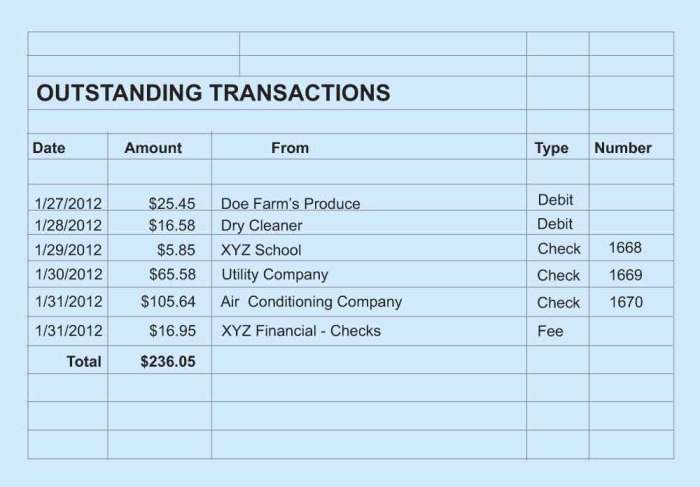

Once you’ve compared the beginning balances, go through each transaction on your checkbook register and compare it to the corresponding transaction on your bank statement. If you find any discrepancies, you’ll need to investigate further.

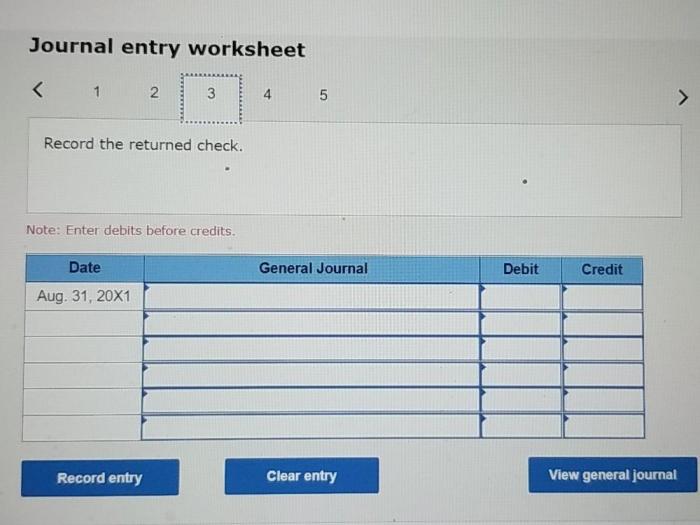

Make adjustments to your checkbook register

Once you’ve identified any discrepancies, you’ll need to make adjustments to your checkbook register. This may involve adding transactions that are missing from your register, correcting the amounts of transactions that are incorrect, or deleting transactions that are duplicates.

Reconcile your checkbook

Once you’ve made all of the necessary adjustments to your checkbook register, you can reconcile your checkbook. To do this, simply subtract the ending balance on your checkbook register from the ending balance on your bank statement. If the result is zero, your checkbook is reconciled.

Tips for Reconciling Your Checkbook

Reconcile your checkbook regularly

The more often you reconcile your checkbook, the easier it will be to find and correct any errors.

Use a checkbook register or budgeting app

A checkbook register or budgeting app can help you keep track of your transactions and make reconciling your checkbook easier.

Keep track of all your transactions

It’s important to keep track of all of your transactions, even small ones. This will help you avoid discrepancies when you reconcile your checkbook.

Review your bank statements carefully

When you review your bank statements, be sure to look for any errors or unauthorized transactions.

Contact your bank if you have any questions

If you have any questions about reconciling your checkbook, don’t hesitate to contact your bank. They can help you troubleshoot any problems you’re having.

Troubleshooting Common Reconciling Problems

Missing transactions

If you find that there are transactions missing from your checkbook register, you may have forgotten to record them. Check your receipts and bank statements to see if you can find the missing transactions.

Incorrect amounts

If you find that the amounts of some of the transactions on your checkbook register don’t match the amounts on your bank statement, you may have made a mistake when recording the transactions. Check your receipts and bank statements to see if you can find the error.

Duplicate transactions, Calculate reconcile your checkbook answer key

If you find that there are duplicate transactions on your checkbook register, you may have accidentally entered the same transaction twice. Delete the duplicate transactions from your checkbook register.

Bank errors

In some cases, the discrepancies between your checkbook register and your bank statement may be due to errors made by your bank. If you think this is the case, contact your bank to report the error.

Benefits of Reconciling Your Checkbook

Keep track of your spending

Reconciling your checkbook is a great way to keep track of your spending. By comparing your checkbook register to your bank statement, you can see where your money is going and identify areas where you can cut back.

Identify potential errors

Reconciling your checkbook can help you identify potential errors in your checkbook register or your bank statement. This can help you prevent fraud and protect your financial information.

Prevent fraud

Reconciling your checkbook can help you prevent fraud by identifying unauthorized transactions. If you find any transactions on your bank statement that you don’t recognize, you should contact your bank immediately.

Manage your finances more effectively

Reconciling your checkbook can help you manage your finances more effectively. By keeping track of your spending and identifying potential errors, you can make better decisions about how to use your money.

Key Questions Answered

How often should I reconcile my checkbook?

It is recommended to reconcile your checkbook at least once a month, or more frequently if you have a high volume of transactions.

What should I do if I find a discrepancy when reconciling my checkbook?

If you find a discrepancy, carefully review your checkbook register and bank statement to identify the source of the error. Contact your bank if you cannot resolve the discrepancy on your own.

What are the benefits of reconciling my checkbook?

Reconciling your checkbook helps you track your spending, identify potential errors, prevent fraud, and manage your finances more effectively.