The internal control procedures in Dayton form the cornerstone of the organization’s financial management system, safeguarding its assets, ensuring the accuracy of financial reporting, and promoting operational efficiency. This comprehensive framework of policies, processes, and practices provides a robust foundation for maintaining the integrity and reliability of Dayton’s financial operations.

Effective internal control systems are crucial for mitigating financial risks, preventing fraud, and enhancing the accuracy and reliability of financial reporting. Dayton’s internal control procedures encompass a range of measures designed to identify, assess, and manage risks, ensuring that the organization’s financial activities are conducted in a responsible and transparent manner.

Internal Control Environment: The Internal Control Procedures In Dayton

The control environment is the foundation of Dayton’s internal control system. It establishes the tone and direction for internal control and influences the effectiveness of all other internal control components.

Key elements of Dayton’s control environment include:

- Management’s philosophy and operating style

- The board of directors’ oversight of management

- The integrity and ethical values of employees

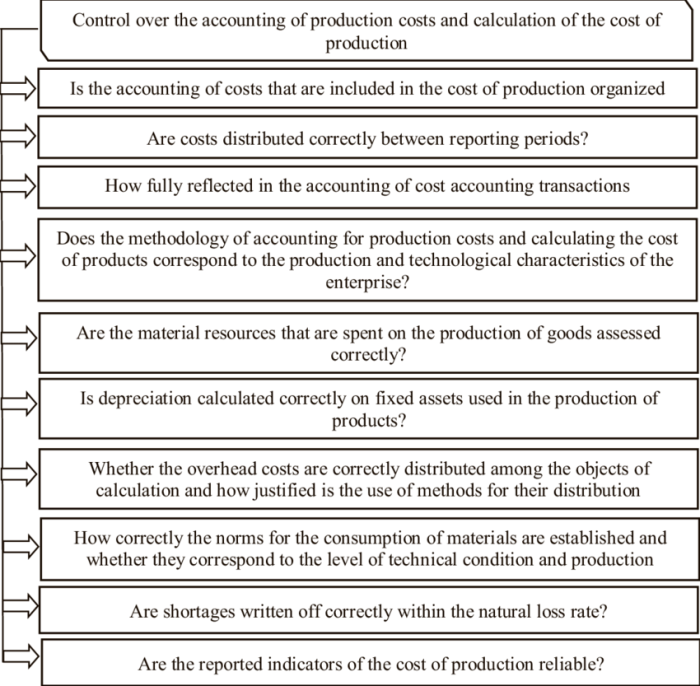

Risk Assessment, The internal control procedures in dayton

Dayton uses a risk-based approach to internal control. This approach involves identifying and assessing risks that could affect the achievement of its objectives.

Key risks that Dayton faces include:

- Financial risk

- Operational risk

- Compliance risk

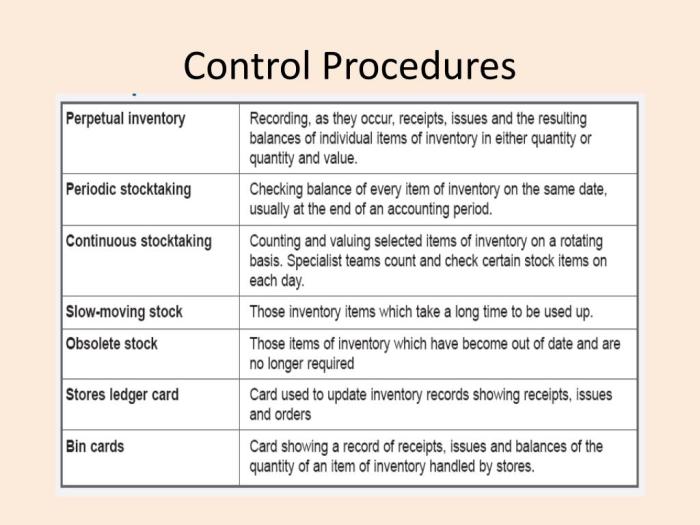

Control Activities

| Control Type | Description | Purpose |

|---|---|---|

| Preventive controls | Policies and procedures designed to prevent errors or fraud from occurring | To reduce the likelihood of errors or fraud occurring |

| Detective controls | Policies and procedures designed to detect errors or fraud after they have occurred | To identify errors or fraud that has occurred |

| Corrective controls | Policies and procedures designed to correct errors or fraud that has occurred | To prevent errors or fraud from reoccurring |

Information and Communication

Effective communication is essential for maintaining internal controls. Dayton uses a variety of communication channels to share financial and operational information, including:

- Formal reporting channels

- Informal communication channels

- Electronic communication channels

Monitoring

Dayton monitors its internal controls on an ongoing basis to ensure their effectiveness. Key indicators used to monitor internal control effectiveness include:

- The number of errors or fraud incidents

- The timeliness of financial reporting

- The accuracy of financial statements

Commonly Asked Questions

What are the key components of Dayton’s internal control system?

Dayton’s internal control system comprises five key components: control environment, risk assessment, control activities, information and communication, and monitoring.

How does Dayton identify and assess risks?

Dayton employs a comprehensive risk assessment process that involves identifying potential risks, evaluating their likelihood and impact, and prioritizing them based on their severity.

What types of control activities does Dayton implement?

Dayton implements a range of control activities, including preventive controls, detective controls, and corrective controls, to mitigate identified risks and ensure the effectiveness of its internal control system.