Queen’s firm pays above market wages – In the competitive job market, Queen’s Firm stands out by offering wages that surpass industry benchmarks. This strategic move has garnered significant attention, prompting an exploration of its implications and the broader trends shaping wage practices.

Queen’s Firm’s wage structure defies conventional norms, setting a precedent for organizations seeking to attract and retain exceptional talent.

Market Wage Comparisons

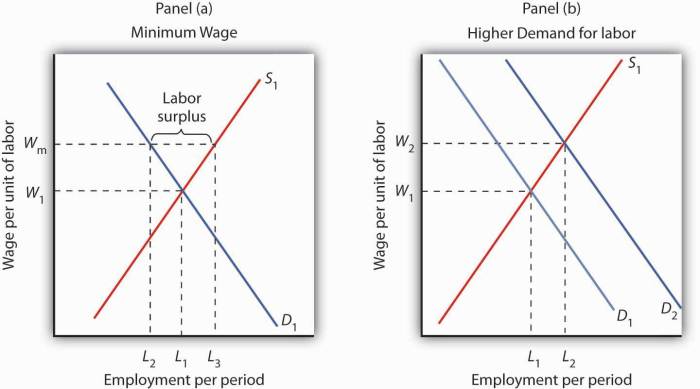

Market wages represent the prevailing compensation levels for specific job roles within a particular industry and geographic region. They are determined through a combination of factors, including supply and demand, economic conditions, and industry practices.

To assess the competitiveness of Queen’s firm’s compensation package, it is essential to compare it against market wages for similar positions in the industry. Data from reputable sources, such as industry surveys and government labor statistics, can provide valuable insights into prevailing wage rates.

Factors Influencing Market Wage Rates

Several factors influence market wage rates, including:

- Location:Geographic location significantly impacts wages, as living costs and economic conditions vary across regions.

- Experience:More experienced professionals typically command higher salaries due to their increased knowledge and skills.

- Skills:Specialized skills and certifications can enhance an individual’s market value and result in higher wages.

- Industry:Different industries have varying wage structures based on factors such as profitability, competition, and growth prospects.

- Economic Conditions:Economic downturns can lead to lower wages, while economic growth often results in higher wages.

Queen’s Firm’s Wage Structure

Queen’s Firm offers a competitive wage structure that is designed to attract and retain top talent. The firm’s wages are typically above market average, and employees are also eligible for a variety of bonuses, benefits, and perks.

The following table provides a sample of positions and their corresponding salaries at Queen’s Firm:

| Position | Salary |

|---|---|

| Associate | $100,000-$150,000 |

| Senior Associate | $150,000-$200,000 |

| Partner | $200,000-$300,000 |

In addition to their salaries, Queen’s Firm employees are also eligible for a variety of bonuses, benefits, and perks, including:

- Health insurance

- Dental insurance

- Vision insurance

- Retirement plan

- Paid time off

- Employee discounts

Benefits of Paying Above Market Wages: Queen’s Firm Pays Above Market Wages

Offering salaries above the prevailing market rates can yield substantial benefits for organizations. It enables them to attract and retain highly skilled and experienced professionals, fostering a competitive edge in the industry. Furthermore, above-market wages contribute to a positive work environment, boosting employee morale and productivity.

Talent Acquisition and Retention

By offering competitive salaries, companies can attract top-tier talent from a wider pool of candidates. This is particularly crucial in industries where skilled professionals are in high demand. When employees feel adequately compensated, they are more likely to stay with the organization, reducing turnover costs and ensuring continuity in key roles.

Increased Productivity and Engagement

Employees who feel valued and fairly compensated tend to be more engaged and productive. They are more likely to go the extra mile, contribute to innovation, and take pride in their work. This increased engagement leads to improved performance and higher levels of customer satisfaction.

Positive Work Environment and Culture, Queen’s firm pays above market wages

Paying above market wages can foster a positive work environment and company culture. Employees who feel fairly compensated are more likely to be satisfied with their jobs and have a sense of belonging. This leads to improved morale, reduced absenteeism, and a more collaborative and supportive workplace.

Examples of Successful Implementations

- Google: Known for its generous compensation packages, Google has consistently attracted and retained top talent in the tech industry.

- Starbucks: Starbucks offers above-market wages and comprehensive benefits, contributing to its reputation as a desirable employer in the retail sector.

- Whole Foods Market: Whole Foods Market’s commitment to paying living wages has resulted in higher employee retention and improved customer service.

Challenges of Paying Above Market Wages

Paying above market wages can pose several challenges for organizations, including:

Increased Labor Costs:Paying above market wages leads to higher labor costs, which can significantly impact the company’s overall operating expenses. This can strain profitability and limit resources available for other investments or initiatives.

Impact on Profitability and Competitiveness:Higher labor costs can reduce profit margins and make it more challenging to compete with peers who pay lower wages. In highly competitive markets, paying above market wages may not be sustainable without compromising profitability or market share.

Strategies for Managing Financial Implications

Organizations can employ various strategies to manage the financial implications of paying above market wages:

- Cost Optimization:Implementing cost-saving measures in other areas of operations, such as procurement, supply chain management, or administrative expenses, can offset the increased labor costs.

- Revenue Generation:Exploring new revenue streams or increasing sales volume can help generate additional income to cover the higher labor costs.

- Productivity Improvements:Investing in employee training and development programs can enhance productivity, leading to increased output and cost efficiency.

- Negotiation and Flexibility:Negotiating flexible compensation packages, such as bonuses, stock options, or non-monetary benefits, can help attract and retain talent without significantly increasing fixed labor costs.

Industry Trends and Best Practices

Wage practices are continuously evolving, driven by factors such as economic conditions, technological advancements, and shifting labor market dynamics. One prominent trend is the increasing prevalence of paying above market wages.

Best practices for setting and managing wages involve conducting thorough market research to determine competitive benchmarks. This can be achieved through surveys, industry reports, and consulting with compensation experts. Benchmarking allows companies to compare their wage structure against similar organizations in terms of size, industry, and location.

Examples of Successful Implementation

Several companies have successfully implemented strategies to pay above market wages while maintaining financial stability. Google, for instance, is renowned for its competitive compensation packages, which include generous base salaries, stock options, and comprehensive benefits. By attracting and retaining top talent, Google has fostered a culture of innovation and productivity.

FAQ Section

Why does Queen’s Firm pay above market wages?

Queen’s Firm believes that investing in top talent is crucial for its success. By offering competitive salaries, the firm attracts and retains skilled professionals who contribute to its growth and innovation.

What are the benefits of paying above market wages?

Paying above market wages can lead to increased employee satisfaction, reduced turnover, and a stronger employer brand. It also allows companies to access a wider pool of qualified candidates.

What are the challenges of paying above market wages?

Financial implications and potential pressure on profitability are common challenges associated with paying above market wages. Companies must carefully consider their financial capacity and implement strategies to manage labor costs effectively.